Your Finances, Your Future

We don’t think you should ever have to choose between your financial goals and your educational goals. So, with Affirm we can offer top-quality education over time.

Buying with Affirm is simple

1. Fill your cart

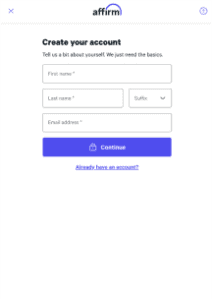

Select Affirm at checkout, then enter a few pieces of info for a real-time decision

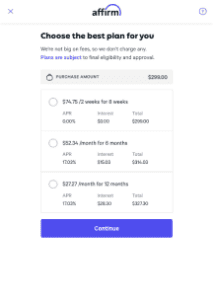

2. Choose how to pay

Pick the payment plan you like best, from 4 interest-free payments every 2 weeks to monthly payments up to 36 months

3. Pay over time

Make payments at affirm.com or in the Affirm app. You’ll get email and text reminders

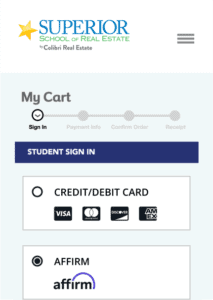

Just select  at checkout

at checkout

Buy with confidence

With Affirm, you always know exactly what you’ll owe and when you’ll be done paying.

Transparent

With Affirm, there are no late fees, service fees, prepayment fees, or any hidden fees. Affirm tells you up front the total amount you’ll pay. That number will never go up.

Flexible

You choose the payment schedule that works for you. Our smart checkout gives you the options.

Fair

Affirm won’t charge you late fees or penalties of any kind, ever.

Your rate will be 0-36% APR based on credit, and is subject to an eligibility check. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR. Payment options through Affirm are provided by these lending partners: http://affirm.com/lenders . Options depend on your purchase amount and a down payment may be required.

Frequently asked questions

Can I select Affirm for any purchase?

Not all purchases will offer Affirm as a payment option. If your final purchase qualifies for Affirm, you will see it offered during checkout.

Can I pay off my purchase early?

Yes! Just contact Affirm directly to arrange your payment.

How do I make my payments?

You can make or schedule payments at affirm.com or in the Affirm app for iOS or Android. Affirm will send you email and text reminders before payments are due.

Can I return an item I bought with Affirm?

Yes, you can return an item you purchased with Affirm. Just start your return with Superior School of Real Estate by following our refund policy.

Does checking my eligibility affect my credit score?

No – your credit score won’t be affected when you create an Affirm account or check your eligibility. If you decide to buy with Affirm, this may impact your credit score. You can find more information in Affirm’s Help Center.

Do I need a mobile number to use Affirm?

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps Affirm verify it’s really you who is creating your account and signing in.

Where can I learn more about Affirm?

You can visit their website at affirm.com.